PAULOWNIA

BIO INNOVATION

FUND (PBIF)

Europe‘s Largest Paulownia

Carbon Farming Project

INVESTMENT CASE

Objective and Approach

-

CO₂ Removal and Timber Production: PBIF invests in Paulownia tree short-rotation coppice plantations, absorbing carbon while producing high-value timber.

-

Dual Revenue Streams: Generates income through timber sales and issuance of CO₂ certificates.

Investor Needs

-

Carbon credit certificates are marketable for offsetting carbon footprints or retained forsustainable portfolios.

-

Diversification in investment portfolios with inflation protection and low correlation to other asset classes.

Market Opportunities

Timber Market

-

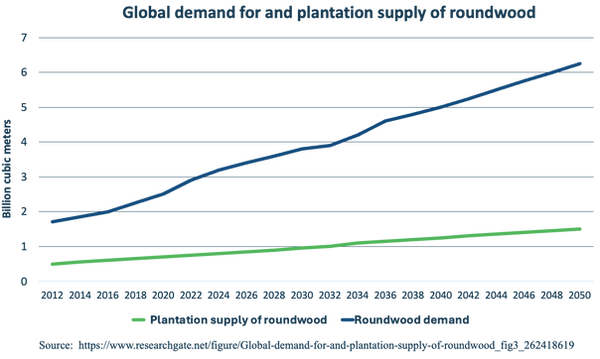

Market Size: Global timber and wood product market expected to

grow through 2050. -

In 2025, the global timber and wood products market is expected to reach about $1.03 trillion, with annual growth of around 6% driven by high demand in construction, furniture, and packaging, along with sustainability trends. Prices are projected to remain elevated due to strong demand and limited supply. (Sources: Grand View Research, Customcy.com, The Business Research Company)

CO₂ Credit Market

-

Demand for CO₂ Offsetting: With regulatory pressures and the drive for global climate neutrality, demand for CO₂ credits is rising.

-

Forecasts: Market value of carbon credits projected to reach

$1.6 trillion by 2028. -

Projections: ~$750–900bn in 2025, rising to $1.6tn by 2028 (based on leading market research CAGR estimates).

PBI FUND STRUCTURE

Structure and Strategy

-

Fund Structure: A closed-end fund aimed at institutional investors, targeting European Paulownia plantations for carbon credits and timber.

-

Investment Strategy: Leasing land and invest in trees and operation of plantations to create sustainable revenue from timber sales and carbon certificates.

-

Target Returns: 20% IRR with a multiple on invested capital (MOIC) of 3.5.

Sustainability and ESG

-

EU Taxonomy Compliance: Fund meets stringent EU sustainability standards.

-

Classified and assessed as an SFDR Article 9 ESG fund.

Biodiversity & Sustainability Goals

Biodiversity

-

No monocultures: All plantations are designed as mixed, multifunctional ecosystems.

-

Intercropping: Combines Paulownia with crops to diversify land use and strengthen ecosystems.

-

Silvopastoral systems: Integrates livestock for soil enrichment and balanced land management.

-

Habitat creation: Light canopy enables undergrowth, pollinators, and beneficial species.

-

Soil & water services: Deep roots improve fertility, prevent erosion, and stabilize hydrology.

Sustainibility

-

All relevant SDGs: Projects are globally aligned with UN sustainability goals.

-

SDG 13 – Climate Action: Certified CO₂ sequestration ensures measurable climate impact.

-

SDG 15 – Life on Land: Intercropping and silvopastoral diversity enhance ecosystems.

-

SDG 8 – Decent Work: Regional jobs and fair value chains strengthen local economies.

-

SDG 17 – Partnerships: Independent monitoring builds trust through strong collaborations.

-

ISO 14064-2: Verified certification standard guarantees transparency and credibility.

-

RISK MANAGEMENT

Risk Management

-

Prosperise Capital systematically identifies and prioritizes risks using targeted strategies (avoidance, transfer, acceptance) with continuous monitoring.

-

Our collaboration partner, bio innovation park Rheinland e.V., applies its agronomic expertise to address site- and cultivation-specific challenges.

-

In partnership with the University of Bonn, bioIP integrates advanced scientific insights to further enhance risk mitigation and ensure project resilience.

TEAM AND PARTNERSHIPS

Experienced Management

-

Prosperise Capital LLP: 18 years of experience in London, Milan, and Miami; specialized in funds and managed accounts.

-

Leadership: Team combines expertise in forestry, carbon markets, and long-term financial assets such as CDOs, NPLs, and Direct Lending.

-

Plantation Management: Prosperise Capital established Prosperise Forestry Management as a fully owned subsidiary to independently manage forestry operations, ensuring separation from asset management.

-

Scientific and Professional Partnerships

-

bioIP Network (Germany): Non-profit network for bioeconomy and green technologies, founded in 2015 with University of Bonn, 2 universities, 50 companies, 3 municipalities.

-

University of Bonn: Scientific partner of bioIP for all agricultural projects; since 2008 leading Paulownia research under Prof. Dr. Ralf Pude, Europe’s foremost Paulownia scientist.

-

ReCO₂Cert Paulownia Carbon Standard: Developed by bioIP; standard for high-quality carbon removals and the projects in which they are generated, ISO 14064-2 certified.

-

Transparency & Returns: Independent environmental auditors and a public project registry ensure credibility, security, and profitability.

-

PAULOWNIA TREE & PLANTATION

PAULOWNIA TREE

-

Paulownia trees exhibit rapid growth, reaching up to a 30 cm trunk diameter in about 7 years while effectively sequestering CO₂ due to their high photosynthetic rate.

-

Their exceptional adaptability to various climates, high drought tolerance, and robust root system make them ideal for short rotation plantations that enable precise, certified CO₂measurement, optimize water use, and enhance soil structure.

-

Their versatile, lightweight, and stable wood delivers both ecological synergies and economic benefits by serving diverse industrial applications and promoting regional value creation.

Plantation

-

Target area: European Union. Initially 4,000 hectares with a density of up to 1,250 trees per hectare. This plantation is expected to sequester approximately 1.5 million tons of CO₂ over a 10-year rotation cycle.

CONTACT INFORMATION

About Prosperise Capital

Prosperise Capital, founded in London in 2009, is a global asset manager specializing in alternative investment strategies. Prosperise Capital is authorized and regulated by the Financial Conduct Authority (FCA) in the UK and is a registered investment advisor with the state of Florida, US.

We have offices in London (UK), Milan (Italy), and Miami (Florida, US)

Location

Prosperise Capital

1 Knightsbridge Green

London, SW1X 7QA

UK

Email: sales@prosperisecapital.com

Tel.: +44 (20) 7959 1200

Website: www.prosperisecapital.com